Property Tax Data

Property Tax - Data Search | County of Lexington - South Carolina

Property Tax - Data Search This website is a public resource of general information. Lexington County makes no warranty, representation or guaranty as to the content, sequence, accuracy, timeliness or completeness of any of the database information provided herein. The reader should not rely on the data provided herein for any reason.

http://lex-co.sc.gov/services/property-tax-data-search

Property & Tax Data | Holland, MI

Property & Tax Data PROPERTY SEARCH Online Property & Tax Information View the property and tax information website, BS&A Online. Here you can look up information regarding Property Taxes, Special Assessments, Sales, and Building data including sketches & photos. City Ordinances

https://www.cityofholland.com/930/Property-Tax-Data

Real Property Tax Database Search | otr - Washington, D.C.

The Office of Tax and Revenue's (OTR) real property tax database provides online access to real property information that was formerly available only through manual searches and at various DC public libraries. You can obtain property value, assessment roll, and other information for more than 200,000 parcels using the links below.

https://otr.cfo.dc.gov/page/real-property-tax-database-search

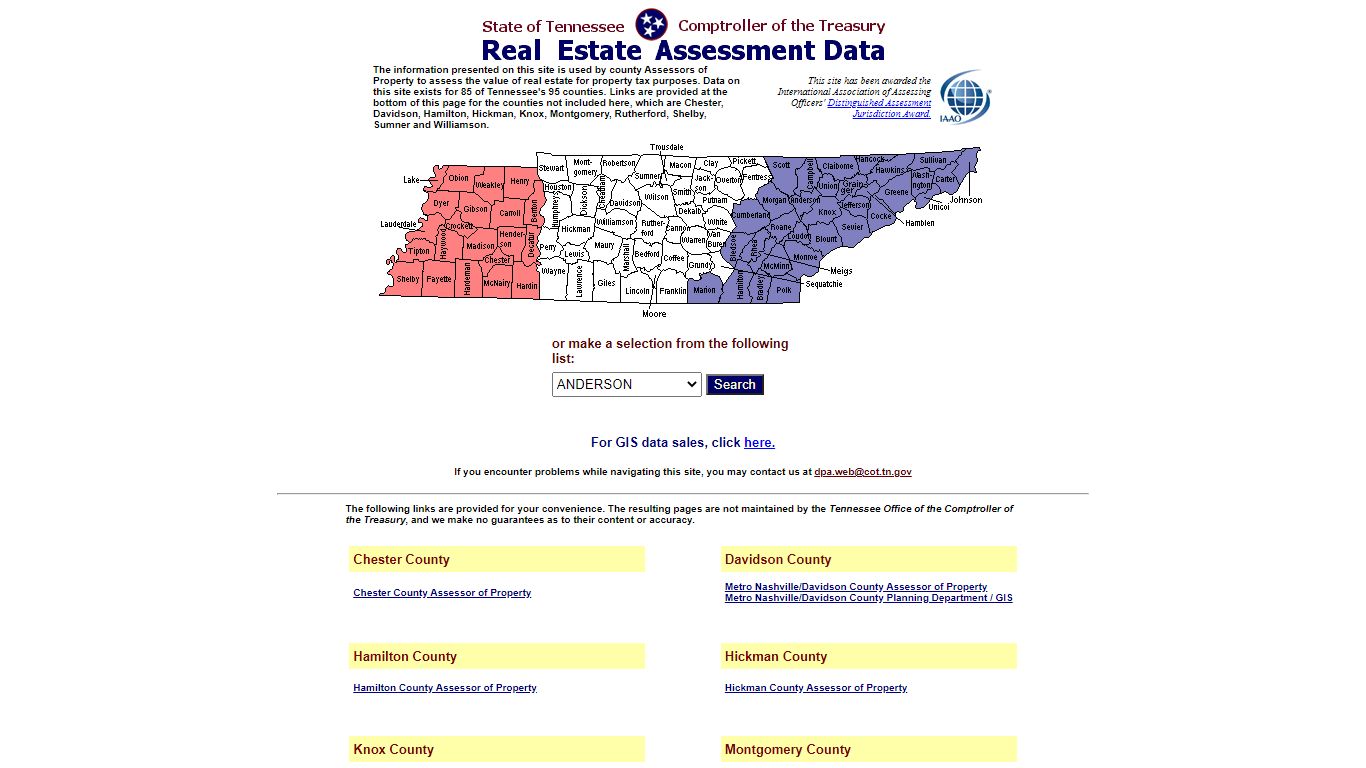

Tennessee Property Data Home Page

Tennessee Property Data Home Page or make a selection from the following list: For GIS data sales, click here. If you encounter problems while navigating this site, you may contact us at [email protected] The following links are provided for your convenience.

https://www.assessment.cot.tn.gov/RE_Assessment/

Property Tax | Galveston County, TX

Property Tax Basics in Texas. Property taxes in Texas are based on the January 1 market value of your property as determined by the county appraisal district (CAD). This is the APPRAISAL phase. CADs handle ownership, exemption and value information. Only the CADs may make changes to your property records (mailing addresses, etc.).

https://www.galvestoncountytx.gov/our-county/tax-assessor-collector/property-tax

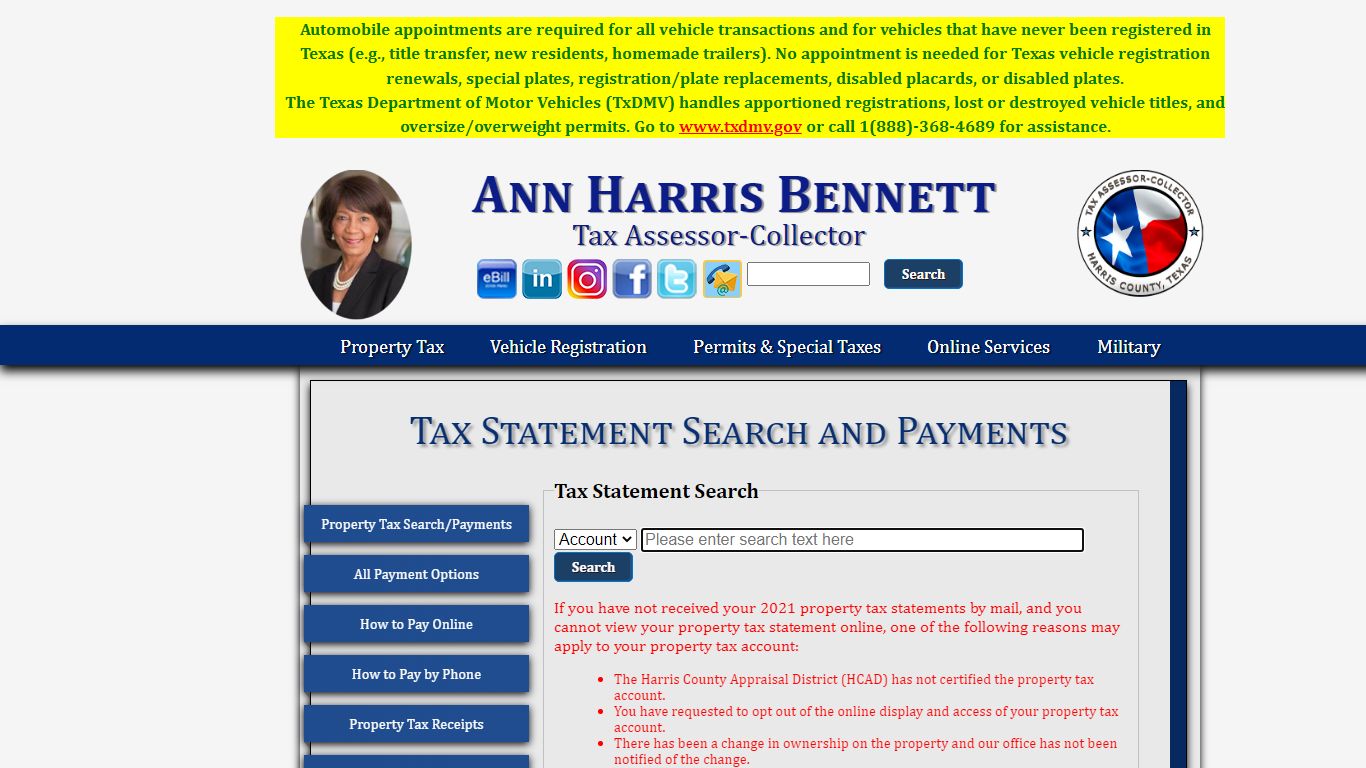

Property Tax Receipts - Harris County Tax Office

The property tax account is being reviewed prior to billing. You are still responsible for payment of your property taxes even if you have not received a copy of your property tax statement (s). Please call 713-274-8000 or send an email to [email protected] to receive a payment amount for your 2021 property taxes.

https://www.hctax.net/Property/PropertyTax

Real Property Assessment & Tax Information | Fairbanks North Star ...

For more information regarding the assessment value of your property, real property ownership or address records, real property tax exemptions, or other Assessing Department functions, please visit the Assessing Department's page or call them at 907-459-1428. For real property ownership information, see the Property Database.

https://www.fnsb.gov/166/Real-Property-Assessment-Tax-Information

Search and Pay Property Taxes - Baltimore County, Maryland

To pay your real or personal property taxes or search for property tax information online, you will need to: Accept the User Terms below. Show. Enter a parcel ID or tax account number. Show. You will find this on your tax bill. Enter only numbers into the system; do not include any dashes or other symbols.

https://www.baltimorecountymd.gov/departments/budfin/taxpayerservices/taxsearch.html

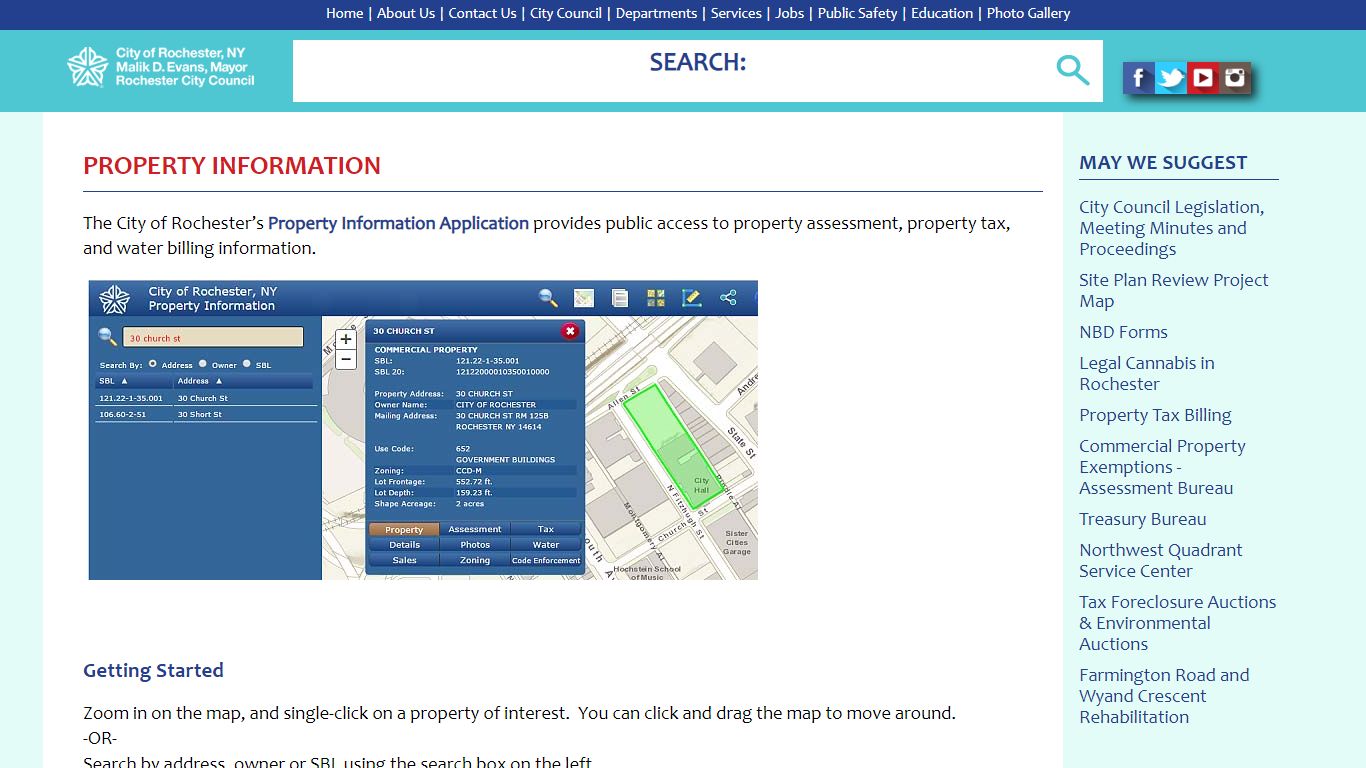

City of Rochester | Property Information

For neighboring towns such as Brighton, Chili, Gates, Greece, Irondequoit or Penfield, check the Monroe County Real Property Portal. If you’re sure that your property is located in the city and you don’t see it on the map, call the City Assessor for more information: (585) 428-7221 My assessment or other tax information is wrong.

https://www.cityofrochester.gov/propinfo/

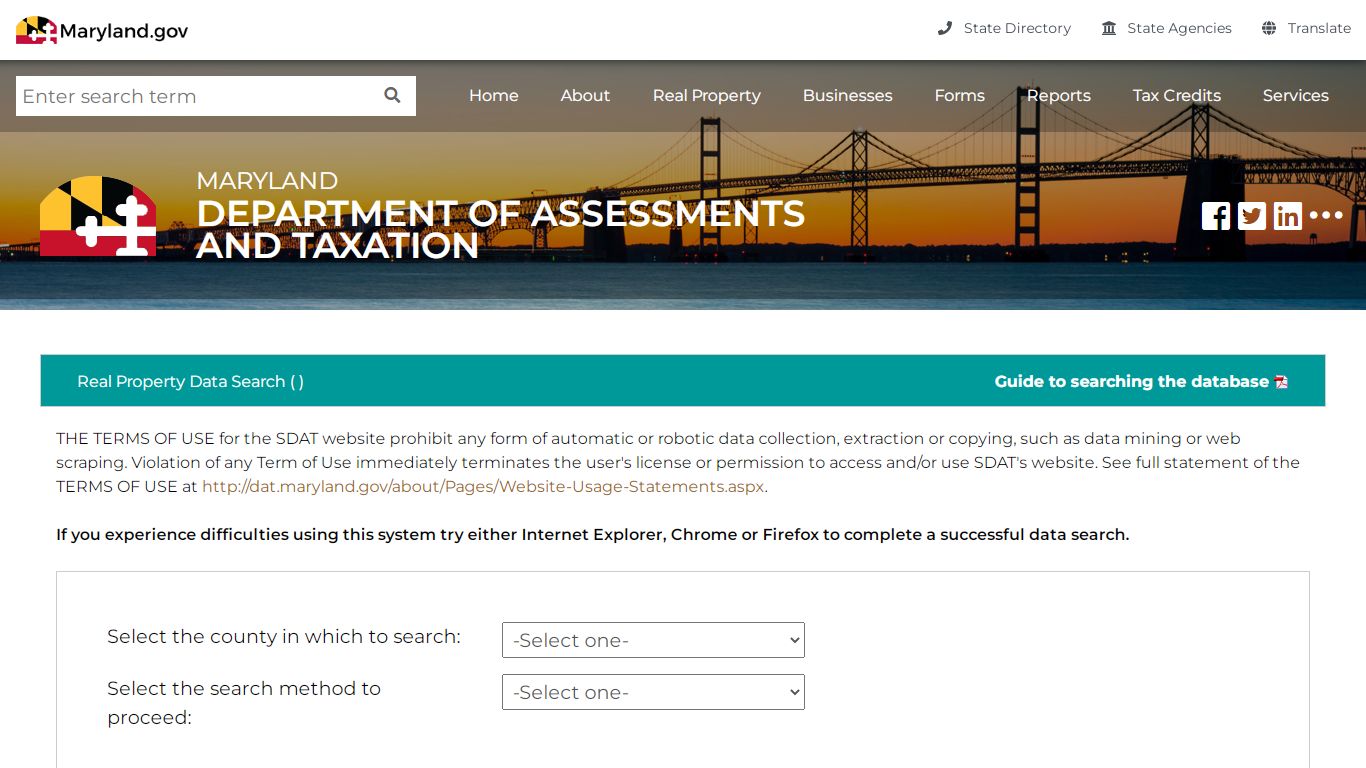

SDAT: Real Property Data Search<

This screen allows you to search the Real Property database and display property records. Click here for a glossary of terms. Deleted accounts can only be selected by Property Account Identifier. The following pages are for information purpose only. The data is not to be used for legal reports or documents.

https://sdat.dat.maryland.gov/RealProperty/Pages/default.aspx

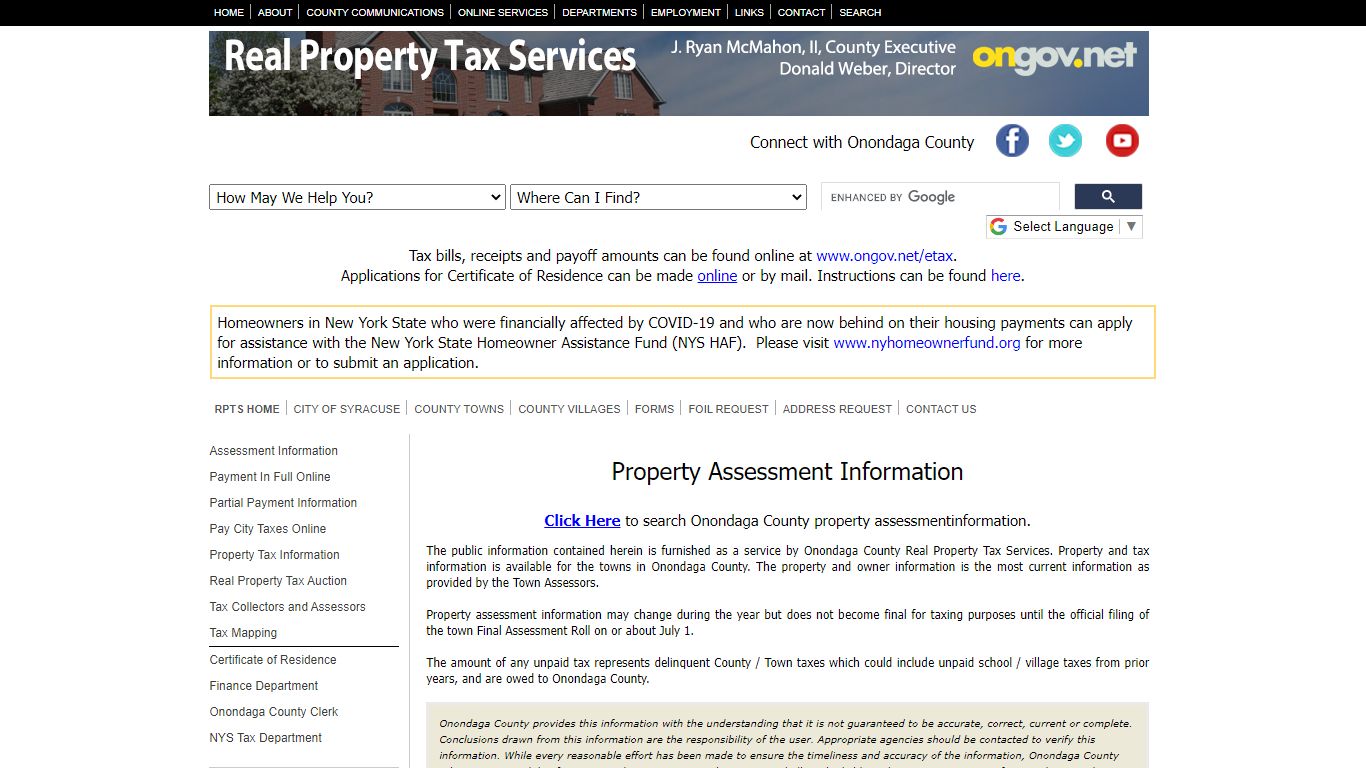

Onondaga County Department of Real Property Taxes

The property and owner information is the most current information as provided by the Town Assessors. Property assessment information may change during the year but does not become final for taxing purposes until the official filing of the town Final Assessment Roll on or about July 1.

http://www.ongov.net/rpts/propertyTaxInfo.html

CITIZEN ACCESS PORTAL - VI

1. view specific parcel property data; 2. view sales data for an entire neighborhood; 3. obtain copies of tax bills; 4. pay real property taxes. Thank you for visiting the Office of the Tax Assessor online via our Citizen Access portal! Kind regards, Ira Mills: Tax Assessor

http://propertytax.vi.gov/